“What’s the Business Value?”

This is one of the most important questions I hear often. Businesses large and small, new and mature, want to best understand how they can maximize the value they deliver to others, such as their customers. The question really includes not only how much value, but where and to whom within an organization. For example:

- Marketing and sales people want to communicate ROI (return on investment) for buying their products over alternatives.

- Early stage startup founders seeking product-market-fit want to know who values their new offering the most.

- Large enterprises considering a company-wide switch to a new software platform need to understand the value throughout the organization.

- Department heads aspire to demonstrate the total value their teams delivers to the company.

- Product managers want to fully understand the customer value of their new products in order to optimize pricing and go-to-market strategies.

But alas, so often, determining this business value is pursued with little structure or rigor.

Back in my days at mega software companies, I was part of elite competitive sales and marketing teams chartered to convince large target Fortune 50 enterprises to switch completely to a different vendor’s software throughout the company. Of course, such large decisions were not made lightly. I helped create and execute Business Value Analyses (BVAs), pre-sales consulting engagements which turned out to be some of the most effective methods in getting competitive accounts to switch.

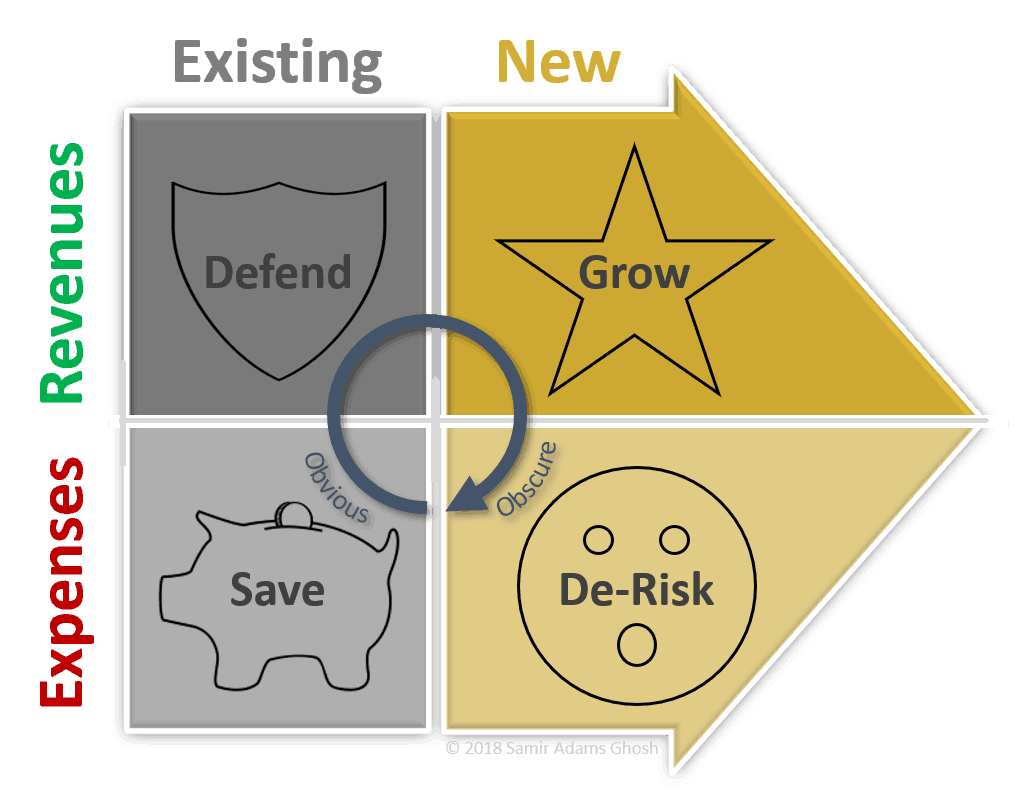

Ultimately, businesses attempt to translate virtually everything into dollars and cents in order to make objective decisions. So a good guide is to leverage the financial income statement, which focuses on revenues and expenses (the vertical axis of the BV QuadArrow).

We would spend days or weeks with a company understanding how things currently operated to create a BVA baseline. Then we explored ways in which our platform/suite could deliver tangible business value by affecting revenues or expenses across the enterprise. However, potential value-add was not limited to just affecting current revenue and expenses but could also affect future revenue and expenses – i.e., existing and new (the horizontal axis of the BV QuadArrow) revenue and expenses.

By using this BV QuadArrow in a comprehensive way, it’s easier to compare relative points of value (e.g., reducing a current cost versus growing marketshare). And it becomes obvious that affecting existing revenue or existing expenses has limited impact – i.e., how can you reduce expenses more than 100% (even if that were possible)? On the other hand, finding new revenues can be theoretically unlimited, which can yield much larger value in absolute numbers. Hence, the “new” quadrants of the BV QuadArrow make up an arrow to depict virtually unlimited potential added value in those two quadrants.

I have used this BV QuadArrow approach now for years in countless situations. For example, it has helped me show early stage tech startups where they can find greater recognized value when it is critical to find the right spearhead market niche. A better understanding of business value (quantitative, qualitative, and to whom) also helps grow business faster via optimized go-to-market and funnel processes.

Now, let’s take a closer look at each quadrant…

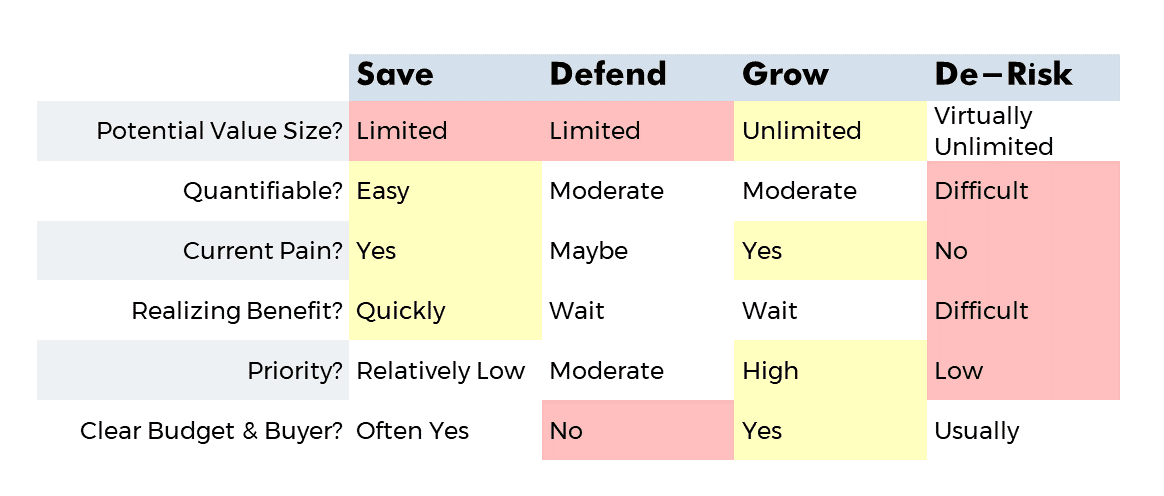

Save

(Save Existing Expenses)

Value propositions in the Save quadrant reduce existing expenses – e.g., cut costs, or save time.

There are often exceptions to any framework, but many people first identify value in the Save quadrant, probably because it’s relatively easy to identify and quantify existing costs or where time is currently spent.

Value props in this quadrant are easily recognized and measurable. And the benefits of any remedy are usually appreciated quickly. However, the potential amount of cost reduction is limited. Unless you’re dealing with a large absolute cost, incremental reductions may not be enough to “move the needle”, at least relative to other priorities within the company.

For example, a startup looking to save hotels on their electricity bills should consider what percent of the hotel’s budget is spent on electricity, then cut that down to the amount they can potentially save. Then compare that to the much larger priority for hotels, occupancy rates. It’ll probably be difficult to get the hotel to prioritize saving relatively small amounts on electricity when they’re constantly scrambling to keep their rooms filled.

Defend

(Defend Existing Revenues)

Value props in the Defend quadrant protect existing revenues – e.g., defend revenues from competition, or reduce attrition.

Unless related pains are already being felt (e.g., sales erosion to competition), this may be the least effective quadrant. It’s often difficult to convey the need to protect something that has not yet been attacked. And, like existing expenses, the potential absolute value is limited (to current revenues).

However, if a company is already losing business to competition, or has user attrition problems, then the decision makers are obvious (e.g., head of sales, or product management, respectively), and they already feel and can quantify the pain.

Grow

(Grow New Revenues)

Value props in the Grow quadrant deliver increased revenues – e.g., upsell existing customers, add new customers, speed time to market (or reduce the risk of delay to market), or enter new markets.

The great news in this quadrant is: Who doesn’t want to grow revenues? If you can (and convince that you can) bring in new revenues, you will likely get attention from senior levels with clear spending authority and urgency. And of course, when it comes to new sales and new markets, the sky’s the limit.

However, for a business that is already growing faster than it can operationally keep up, growing revenues further may not be relatively important.

De-Risk

(Reduce New Expenses)

Value props in the De-Risk quadrant reduce, impede, or prevent new expenses – e.g., avoid product recalls, litigation, new regulatory compliance expense, or insurance premium increases.

These are often the least obvious and, unless already experienced, least felt pain. But the business value is virtually unlimited, limited only to the entire value of the company (e.g., if a calamitous event bankrupts the company). This can be like selling insurance. Once “burned,” prospects are eager to buy insurance. Before that, insurance is a tough sell.

However, risk or legal managers may appreciate the value from their experience, perhaps at previous companies. And even when probabilities are low, Expected Value calculations can be convincing when you include the huge potential cost (e.g., of litigation or a product recall).

The BV QuadArrow doesn’t provide a comprehensive checklist of all possible business value areas, but it can provide a framework for exploring areas of value you bring to an entity. It can be particularly effective if using collaboratively with the prospect, e.g., if built into the discovery step of a sales process.